The ATR XH Volume Indicator for MT4 combines the Average True Range (ATR) with trading volume data to provide forex traders with deeper insights into market volatility and momentum. By plotting the ATR alongside trading volume, it helps traders identify periods of high activity that often precede major price movements.

Volume plays a crucial role in technical analysis, offering clues about the strength or weakness of market trends. The ATR XH Volume Indicator helps traders confirm these signals, making it an invaluable tool for both beginners and experienced forex traders.

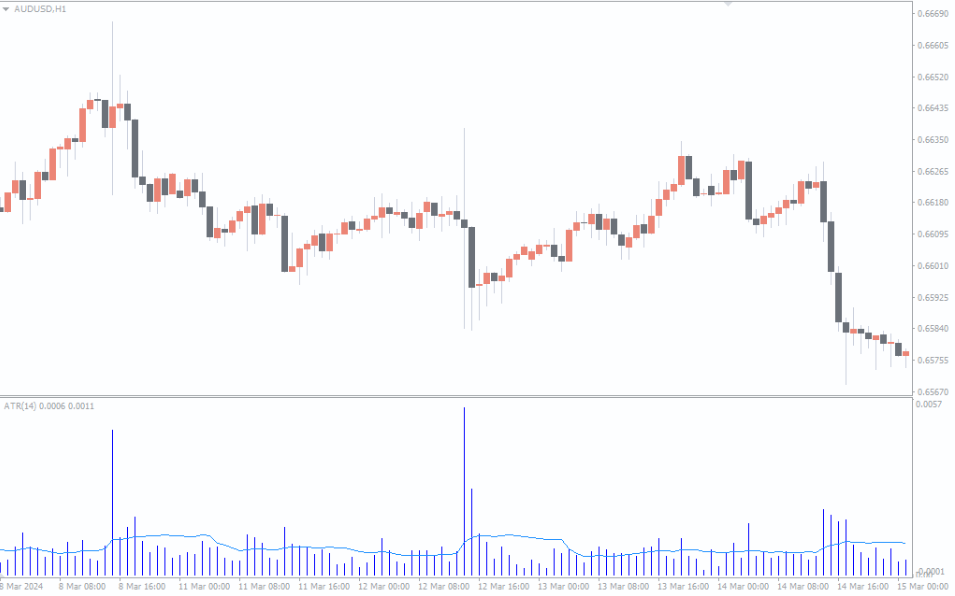

This indicator displays blue volume bars and overlays a dodge-blue ATR line in a separate indicator window within MT4. When trading volumes spike above the ATR line, it signals heightened market activity—often linked with trend continuation or reversal.

High volume with an uptrend: may indicate strong bullish momentum.

High volume with a bearish candle: could signal a potential reversal.

Low volume: often indicates market indecision or consolidation.

These signals should always be used in confluence with other technical indicators and price action for confirmation. For instance, pairing it with indicators like Moving Averages, RSI, or MACD can enhance signal accuracy.

Volume helps traders understand the intensity of market participation behind a price move. When combined with ATR, it offers a dynamic way to gauge volatility and potential trade entries.

Key benefits include:

Detecting trend continuation or exhaustion points

Improving entry and exit timing

Supporting risk management decisions

Providing additional confirmation for other signals

Understanding volume behavior is especially useful for strategies like scalping, day trading, or swing trading—all of which can benefit from the ATR XH Volume Indicator on MT4.

The ATR XH Volume Indicator works effectively on all intraday and higher timeframes, including daily, weekly, and monthly charts.

Here’s how traders can use it:

Scalping: Watch for short-term volume spikes on 1-minute to 15-minute charts.

Day Trading: Use the indicator to confirm breakouts or trend continuations.

Swing & Position Trading: Analyze volume dynamics across multiple days to identify trend strength.

New traders should have a solid understanding of price action, chart patterns, and candlestick formations before relying solely on volume signals.

Imagine an uptrend where volume suddenly spikes, and the ATR line rises sharply. If the accompanying candlestick forms a bullish continuation pattern, it can confirm that buyers are entering the market strongly. Conversely, if a bearish engulfing candle forms on heavy volume, it might suggest a trend reversal.

Always remember that context is key. Volume surges can mean different things depending on the market condition and timeframe.

In summary, the ATR XH Volume Indicator for MT4 is a powerful addition to any trader’s toolkit. It blends volatility (ATR) and market participation (volume) into one simple, effective signal window. While it’s easy to use, traders should apply it alongside other technical indicators for confirmation.

Whether you’re a new trader learning market dynamics or an experienced analyst fine-tuning entries, this indicator can significantly improve your understanding of volume behavior in forex.

👉 Download and explore the ATR XH Volume Indicator today at IndicatorForest.com to enhance your MT4 trading strategy.

Published:

Oct 16, 2025 05:42 AM

Category: