The Deltaforce Indicator for MT5 is a powerful trading tool designed to detect bullish reversals by analyzing buy order accumulation. When the indicator displays blue and pink bars in the sub-window below your chart, it signifies growing buy pressure and potential market reversals.

Traders use the Deltaforce Indicator to track Smart Money activity — the large institutional investors and banks that drive major price movements. Available for all timeframes, it’s suitable for both short-term and long-term strategies.

When you load the Deltaforce Indicator on your MT5 chart, you’ll notice colored bars — typically blue and pink — forming below the price action.

Blue bars indicate the buildup of buy orders and the possibility of a bullish reversal.

Pink bars may appear when the momentum begins to fade, signaling a potential slowdown or upcoming consolidation.

These visual cues are simple yet powerful. The higher the bar, the stronger the buying momentum — suggesting that Smart Money is entering the market.

Spotting Bullish Reversals

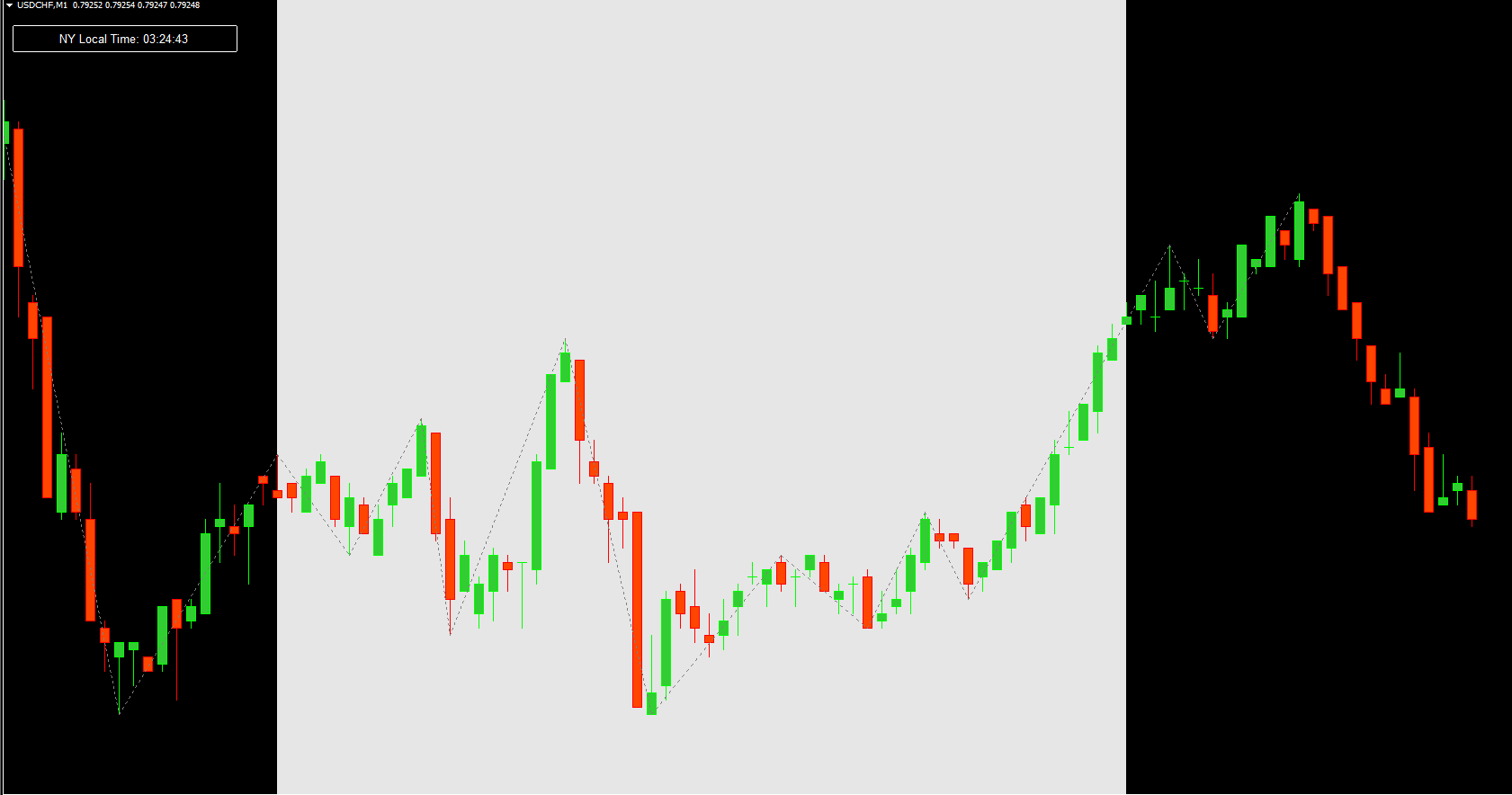

On an AUDNZD H1 chart, for example, you’ll see how long blue bars form as buy orders pile up. These bars often appear before a sharp move upward, confirming bullish reversals.

As the Deltaforce bars extend higher, it indicates increased institutional activity. In other words, banks and financial institutions are accumulating positions — and retail traders can follow their trail to ride the trend.

Consolidation and Trend Strength

During sideways or consolidation periods, the Deltaforce Indicator leaves the area blank. This absence of bars means the market lacks strong directional pressure.

However, when bars start rising again, it often precedes a new bullish phase.

Keep in mind that while the indicator can show strong bars during bearish markets, it’s primarily optimized for bullish setups. For confirmation, combine it with support/resistance analysis or other technical indicators like moving averages or RSI.

Works on All Timeframes: Whether you’re a scalper or swing trader, Deltaforce adapts easily to M1, H1, or even D1 charts.

Visual and Easy to Interpret: The colored bars offer clear visual cues, ideal for beginners.

Smart Money Insight: By reflecting institutional order flow, it helps traders align with the market’s true direction.

Customizable Strategy Integration: You can combine Deltaforce with other MT5 tools to refine entry and exit signals.

Start with Bullish Setups: Focus on long trades since the indicator specializes in identifying buy-side accumulation.

Use Confirmation Tools: Combine Deltaforce signals with candlestick patterns or moving averages for stronger confirmation.

Avoid Flat Markets: The indicator performs best when volatility is moderate to high.

Backtest Your Strategy: Before live trading, test the Deltaforce Indicator on historical data to understand its behavior under different market conditions.

The Deltaforce Indicator for MT5 is a dynamic tool that highlights Smart Money accumulation through colored bars. When high blue bars appear, it signals a potential bullish reversal — giving traders an early indication of trend shifts.

However, remember that Deltaforce isn’t designed for bearish markets. Combining it with technical analysis tools or other indicators enhances accuracy and helps you avoid false signals.

If you’re looking for advanced MT5 indicators that improve your trading precision, visit IndicatorForest.com to explore our full collection.

Published:

Oct 19, 2025 03:42 AM

Category: