The Currency Pairs Correlation Indicator for MT4 is a powerful forex trading tool that helps traders analyze how different currency pairs move in relation to one another. Understanding these relationships—known as correlations—is essential for effective risk management, hedging, and strategy optimization.

Some forex pairs tend to move in the same direction (positive correlation), while others move in opposite directions (negative correlation). With the Currency Pairs Correlation Indicator, traders can quickly identify these relationships and make more informed decisions, minimizing exposure to redundant or conflicting trades.

Currency correlation measures how one currency pair’s price movement relates to another. This correlation is expressed as a coefficient between -1 and +1:

(Perfect Positive Correlation): Both pairs move in the same direction almost all the time.

(Perfect Negative Correlation): The pairs move in opposite directions consistently.

(No Correlation): The pairs move independently of each other.

For example, EUR/USD and GBP/USD often have a strong positive correlation, while USD/JPY and EUR/USD may show a negative correlation.

By tracking these relationships, the Currency Pairs Correlation Indicator for MT4 helps traders avoid taking trades that cancel each other out or double their risk unintentionally.

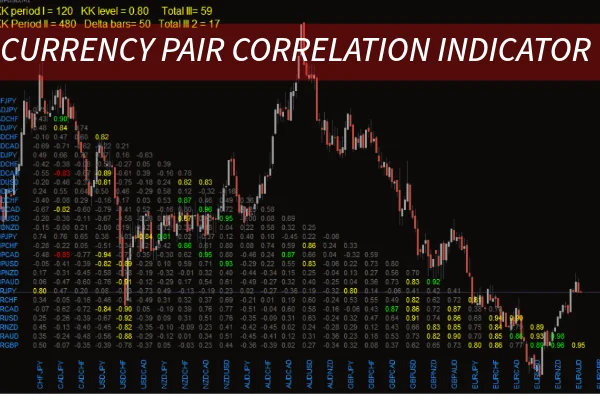

The indicator calculates correlation coefficients over various timeframes and displays them directly on the MetaTrader 4 (MT4) chart. This allows traders to visually assess which pairs are moving together and which are diverging.

Key Features of the Indicator

Real-time correlation calculation across multiple timeframes.

Visual display of correlation values directly on the MT4 chart.

Easy-to-read color-coded system for quick interpretation.

Adjustable parameters to fit your trading style.

By integrating this indicator into your trading setup, you can identify which pairs to trade together and which to avoid.

Identifying Correlated Pairs

When two pairs show a high positive correlation, opening trades in both directions may lead to redundant exposure—essentially doubling your risk. For instance, if you go long on EUR/USD and GBP/USD simultaneously, both trades might move the same way.

On the other hand, a strong negative correlation (e.g., EUR/USD vs. USD/CHF) can be leveraged for hedging strategies, allowing traders to offset potential losses in one pair with gains in another.

Multi-Timeframe Analysis

Correlation values can vary across timeframes. The Currency Pairs Correlation Indicator for MT4 enables traders to monitor correlations over short-term and long-term periods, providing deeper insight into market dynamics and improving decision-making for both day trading and swing trading.

Improved Risk Management: Avoid overexposure by identifying correlated trades.

Enhanced Strategy Diversification: Combine pairs with low or negative correlations for balanced portfolios.

Smarter Hedging: Use negatively correlated pairs to protect open positions.

Time Efficiency: Instantly visualize correlations without manual calculations.

By incorporating the Currency Pairs Correlation Indicator for MT4 into your trading routine, you gain an analytical edge that can significantly enhance profitability and consistency.

The Currency Pairs Correlation Indicator for MT4 is an indispensable tool for every forex trader aiming to improve risk management, refine strategies, and gain a clearer understanding of market relationships.

Whether you trade major pairs or cross pairs, this indicator provides actionable insights into how different markets interact. Download it today and start leveraging correlation analysis to enhance your trading success.

👉 Visit IndicatorForest.com to get the Currency Pairs Correlation Indicator for MT4 and explore more advanced forex tools to boost your trading performance.

Published:

Oct 13, 2025 06:51 AM

Category: