The Choppiness Index Indicator for MT4 is a powerful technical analysis tool designed to help forex traders identify whether the market is trending or moving sideways. Since the forex market rarely moves in a perfectly straight line, understanding the difference between a choppy and directional market is crucial. This indicator makes the task easier by visually displaying market conditions so traders can adapt their strategies accordingly.

The Choppiness Index is especially useful for beginners who often struggle to differentiate between sideways consolidation and strong trends. Experienced traders also benefit by using the indicator to build more advanced trading systems and avoid entering trades during unfavorable market conditions.

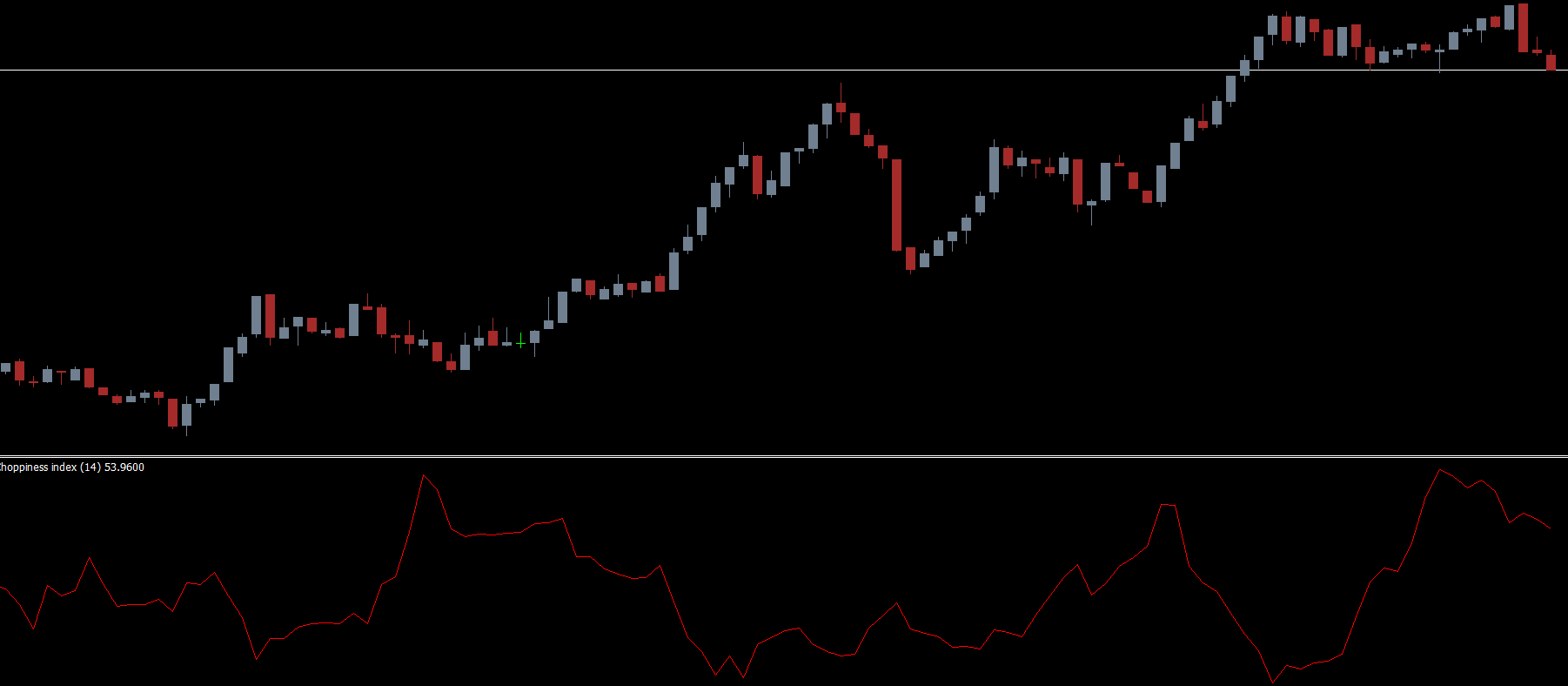

The indicator is based on chaos theory and fractal geometry, using HIGH and LOW price levels to calculate market behavior. When plotted in a separate window on the MT4 chart, the indicator displays values as red lines that oscillate between choppy and trending zones.

Above 61.8 → market is choppy or sideways

Below 38.2 → market is trending (uptrend or downtrend)

This simple structure allows traders to quickly determine whether to prepare for breakout trades or range-bound setups.

Knowing whether a market is trending or consolidating helps traders:

Avoid trading in noisy, unstable conditions

Ride trends confidently

Enter breakouts early

Plan profitable strategies based on real market structure

The indicator also prevents many common trading mistakes, such as entering trend strategies during consolidation or trying to scalp during strong trends.

In the standard version, the indicator identifies choppy and trending zones using Fibonacci-based levels (38.2 and 61.8). For example, when the indicator reading breaks below 38.2, it signals the start of a trend. This is often used as a cue for BUY or SELL entries depending on the direction of the price.

Traders can:

BUY breakouts when the value drops below 38.2 in an upward movement

SELL breakouts when the value drops below 38.2 in a downward movement

Once the trend begins, the indicator helps traders ride the move until choppiness begins to rise again.

Some traders prefer customizing the indicator to make the choppy and trending zones clearer. By adjusting the 38.2 and 61.8 levels, traders can enhance the readability of the chart.

A common technique is:

When values hit 61.8 but fail to break above it for three consecutive attempts, it signals the end of choppiness and potential start of a trend.

Conversely, when levels remain above 61.8 consistently, it confirms the market is still in consolidation.

This setup works particularly well for intraday traders who frequently encounter sideways price movements between support and resistance zones.

Sideways markets are often frustrating for traders, especially those waiting for trends. However, the Choppiness Index helps identify these conditions early so traders can switch to range-based strategies.

For example:

Buying near support

Selling near resistance

Using oscillators like RSI as confirmation

Avoiding breakout trades when the index is above 61.8

This flexibility allows traders to prepare strategies for both trending and non-trending markets.

Always confirm signals with price action

Combine with tools like Fibonacci levels or trendlines

Adjust indicator settings during strong trending phases

Avoid relying on the indicator alone—use it for context, not blind signals

The Choppiness Index Indicator for MT4 is an essential tool for forex traders who want to understand market structure accurately. It quickly shows whether the market is trending or moving sideways, helping traders avoid costly mistakes and build effective strategies. Easy to install, beginner-friendly, and free to download, this indicator should be part of every trader’s toolbox.

For more powerful trading tools and free indicators, visit IndicatorForest.com today and explore our complete indicator library.

Published:

Nov 25, 2025 21:35 PM

Category: