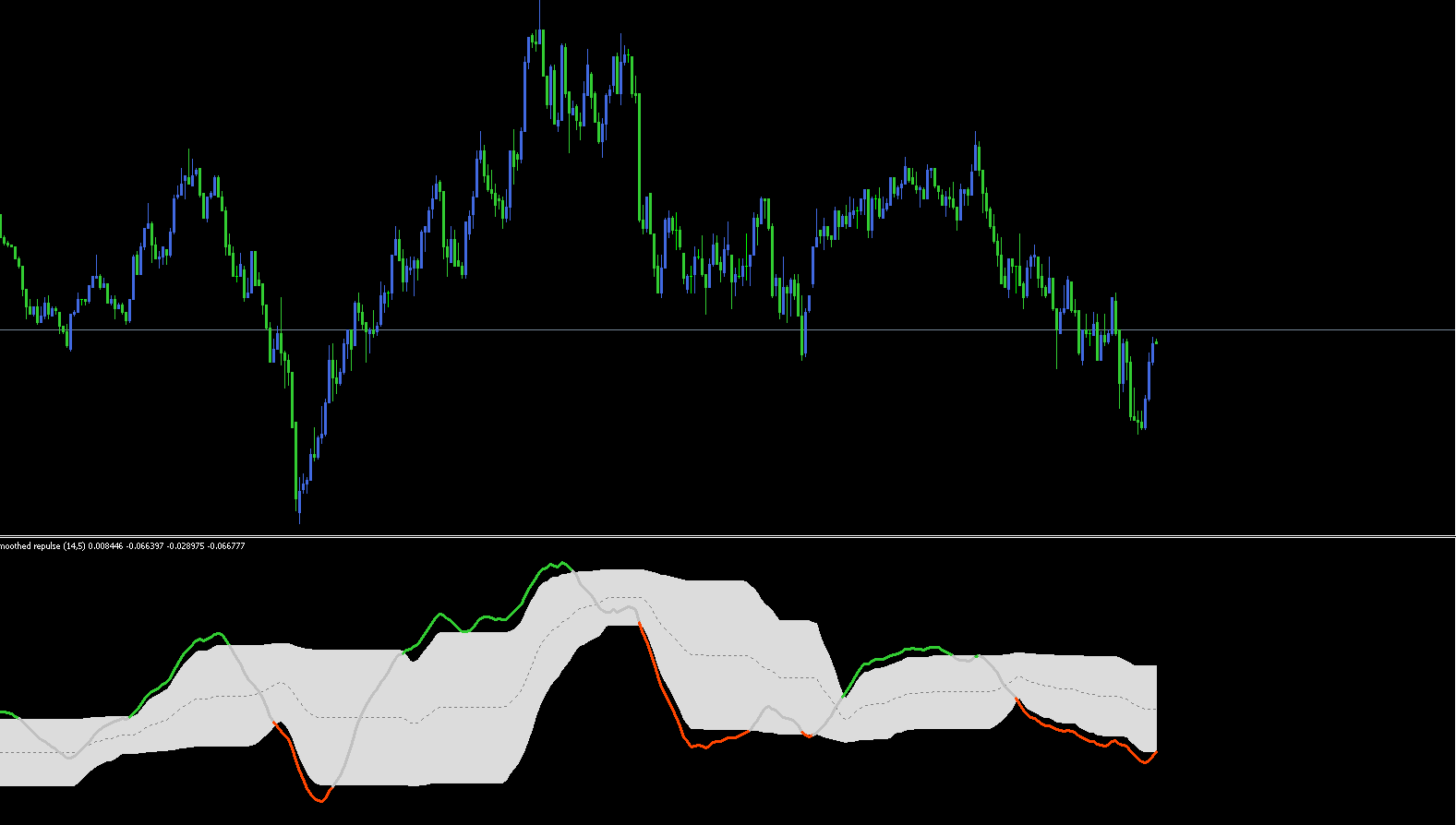

The Smoothed Repulse 2 Indicator is a powerful trading tool designed to analyze market sentiment and trader confidence. Unlike traditional oscillators such as RSI, MACD, or Stochastic, this indicator focuses not just on price action, but on the psychological pressure behind each candle. By quantifying and visualizing the “push” or “repulsion” of each price move as a curve, it offers traders a deeper understanding of momentum and potential trend reversals.

This advanced indicator is built around two main elements: the zero line and the repulse line.

When the Repulse line rises above the zero line, it indicates buying pressure and growing bullish sentiment.

When it falls below, it signals selling pressure and potential bearish dominance.

The Smoothed Repulse 2 Indicator for MT5 filters out market noise, making its readings smoother and more reliable than the standard version. By observing its fluctuations, traders can identify when the market is overbought or oversold, helping to time entries and exits more effectively.

To maximize its effectiveness, traders often plot multiple Repulse values such as Repulse(1), Repulse(5), and Repulse(15) on the same chart. This multi-timeframe approach helps identify both short-term and long-term market trends simultaneously.

Here’s how to interpret it:

Above Zero Line: Increasing buying momentum and bullish trend.

Below Zero Line: Rising selling momentum and bearish trend.

High Positive Values: Overbought condition — potential sell signal.

High Negative Values: Oversold condition — potential buy signal.

By analyzing the slope and intensity of the Repulse line, traders can also gauge trend strength and potential reversals more accurately.

There are several reasons why traders rely on the Smoothed Repulse 2 Indicator:

Enhanced Market Insight – It reflects trader confidence and market psychology.

Smooth Filtering – Reduces false signals caused by price noise.

Multi-Timeframe Flexibility – Suitable for intraday and swing trading.

Simple Integration – Works seamlessly with MetaTrader 5 (MT5).

In contrast to common oscillators like RSI or MACD, the Smoothed Repulse 2 focuses on sentiment momentum rather than just price changes, making it an excellent complement to other technical tools.

Combine the Smoothed Repulse 2 with moving averages or trendlines for confirmation.

Use divergence signals (when price and indicator move in opposite directions) to spot early reversals.

Backtest your strategy before using it in live markets to improve accuracy and confidence.

The Smoothed Repulse 2 Indicator is not just another oscillator—it’s a sentiment-based analysis tool that gives traders a psychological edge. By understanding how market participants react to price movements, you can make smarter, data-driven trading decisions.

Start exploring the Smoothed Repulse 2 Indicator and other powerful tools at IndicatorForest.com to enhance your technical analysis and trading performance.

Published:

Nov 03, 2025 13:40 PM

Category: