The All Woodies CCI Indicator for MT4 is a powerful non-repaint trend indicator based on the Commodity Channel Index (CCI). It helps traders identify the current market direction, measure momentum strength, and detect potential reversal zones.

The classic CCI has long been used by forex and stock traders for identifying trend shifts and price divergences. The All Woodies CCI takes this analysis a step further by offering a more informative and user-friendly interface that includes multi-timeframe (MTF) readings and clear overbought/oversold alerts.

The Commodity Channel Index (CCI) measures how far price has moved from its statistical average. When combined with additional filters and color-coded signals, it becomes a versatile trading tool.

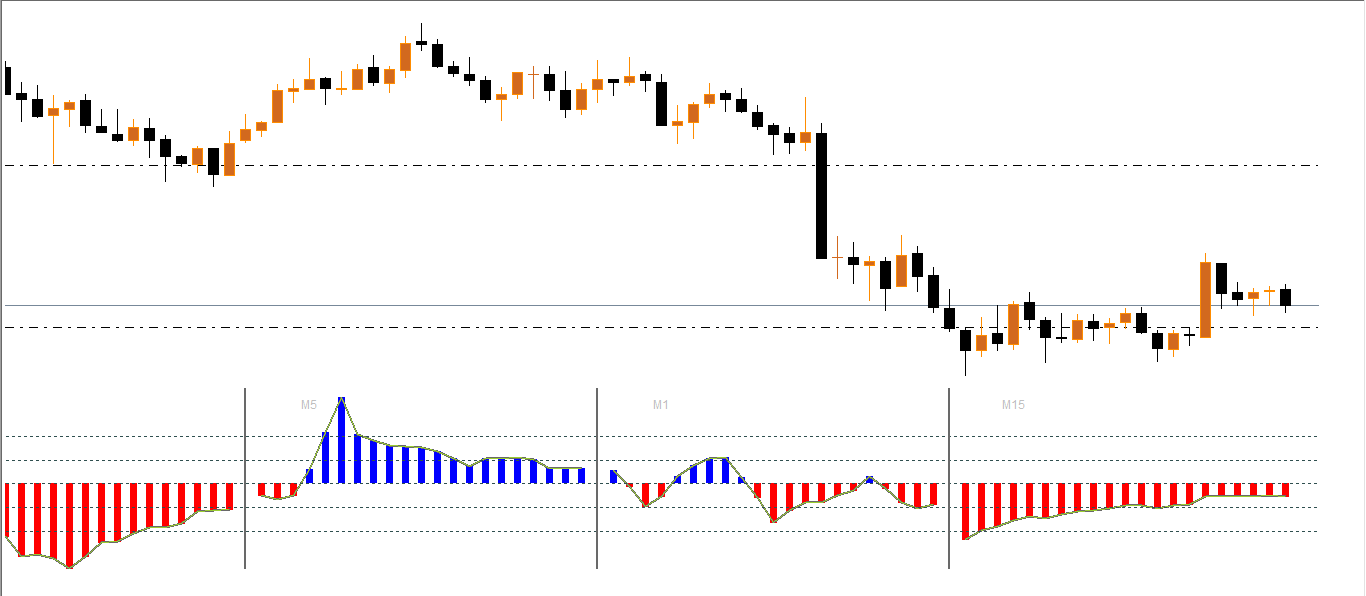

The All Woodies CCI displays CCI values from multiple timeframes simultaneously—such as H4, M1, M3, M10, M15, and H1—within a single indicator window. This multi-timeframe feature helps traders quickly confirm trend alignment before placing trades.

By default:

Blue bars above zero → Bullish trend.

Red bars below zero → Bearish trend.

100 to 200 zone → Overbought region (possible sell signal).

–100 to –200 zone → Oversold region (possible buy signal).

These visual cues make it easy for traders to gauge the strength and direction of market momentum at a glance.

Look for buy opportunities when the CCI value crosses above –100 from below, signaling that the market is leaving the oversold area.

If this upward move coincides with a bullish breakout in price, it confirms strong upward momentum and a valid long entry.

When the CCI value drops below 100, it indicates a loss of bullish strength.

If the price simultaneously breaks below a consolidation zone or support level, the indicator confirms a bearish reversal, signaling a potential short trade.

Before taking a position, check that the majority of the MTF bars are in agreement.

For instance, if most higher-timeframe bars (H1, H4) are blue, favor long setups. Conversely, if they are red, prioritize short trades.

Combine the indicator with price action tools such as trendlines or support and resistance.

Avoid entering trades when the CCI hovers around the zero line since it often indicates a sideways market.

Adjust the indicator’s timeframes to match your trading style—short-term scalpers may prefer lower TFs, while swing traders can use higher TFs.

Non-repaint indicator ensures stable signals.

Detects trends, momentum strength, and reversal zones in real time.

Displays multi-timeframe trend conditions in one window.

Suitable for forex, stocks, commodities, and cryptocurrencies.

Perfect for both beginners and advanced traders.

The All Woodies CCI Indicator for MT4 is a comprehensive trend and momentum tool that enhances the standard Commodity Channel Index by adding multi-timeframe analysis and color-coded signals. It accurately identifies bullish/bearish trends, divergences, and overbought/oversold conditions, making it a valuable asset for any trader’s toolbox.

Whether you trade forex, stocks, or crypto, the All Woodies CCI provides clear and actionable insights to help you make better trading decisions. Download it today and enhance your trend-trading strategy on MT4!

Published:

Nov 09, 2025 02:54 AM

Category: