The WCCI Indicator for MT5 (Weighted Commodity Channel Index) is a powerful technical tool built on the traditional CCI indicator framework. Designed to deliver improved accuracy, it measures market momentum and detects overbought and oversold conditions more effectively. Unlike the standard CCI, the Weighted CCI (WCCI) uses a weighted period, making it more sensitive and responsive to short-term price movements.

At IndicatorForest.com, you can download the WCCI Indicator for MetaTrader 5 and enhance your technical analysis with greater precision and smoother trend detection.

The Commodity Channel Index (CCI) is a well-known oscillator used to identify cyclical trends in price action. It measures how far the current price deviates from its statistical average, revealing potential turning points in the market.

CCI readings above +100 traditionally suggest an overbought market condition, where prices might soon retrace downward.

CCI readings below -100 indicate oversold conditions, hinting that prices could bounce upward.

However, the WCCI Indicator for MT5 enhances this traditional approach by adjusting these boundaries to +200 and -200. This modification helps traders filter out false signals, especially in markets with higher volatility, such as cryptocurrencies, commodities, and indices.

The WCCI Indicator calculates the weighted moving average of price data to highlight the most recent changes in market behavior. This weighting process gives more importance to the latest price movements, making the indicator more adaptive to rapid trend shifts.

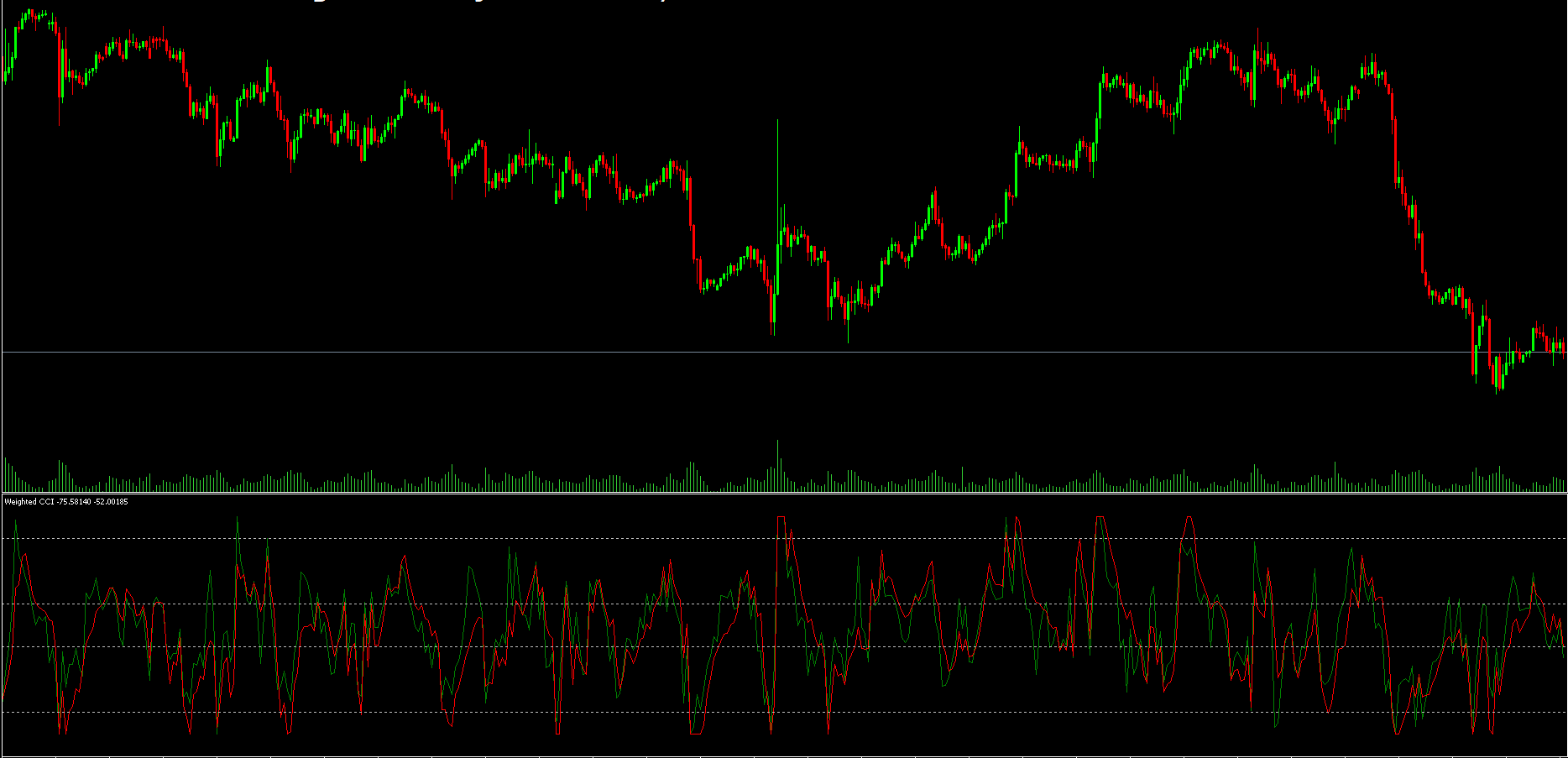

On your MetaTrader 5 chart:

The red horizontal bars represent the overbought (+200) and oversold (-200) zones.

The dodger blue line serves as the signal line, moving dynamically between these levels.

When the blue line touches or crosses these boundaries, it generates potential buy or sell signals, giving traders visual cues to act upon.

Trading with the WCCI Indicator for MetaTrader 5 is straightforward once you understand its visual signals:

Buy Setup:

When the blue signal line dips below the -200 oversold zone and reverses upward, it suggests a potential buy opportunity.

Confirm with price action (e.g., bullish candlestick patterns) before entering.

Sell Setup:

When the signal line moves above the +200 overbought zone and reverses downward, it implies a sell opportunity.

Always validate with support/resistance levels or trend confirmation tools.

For optimal results, traders often combine the WCCI Indicator with other tools such as moving averages, RSI, or MACD. This multi-indicator strategy helps improve signal reliability and reduce false entries.

Here are the key advantages of using this enhanced version of the Commodity Channel Index:

Higher Sensitivity: The weighted calculation reacts faster to price movements.

Improved Accuracy: Wider thresholds (+200/-200) reduce noise in volatile markets.

User-Friendly Interface: Simple and visually clear setup for both beginners and experts.

Compatible with All Assets: Works on Forex, crypto, indices, stocks, and commodities.

The WCCI Indicator is ideal for traders seeking momentum-based entries and clear exit signals.

The WCCI Indicator for MT5 is a refined version of the classic CCI that delivers improved responsiveness and more reliable signals. By using weighted averages and customized overbought/oversold levels, it helps traders better understand price extremes and trend reversals.

However, remember that no indicator is perfect. Use the WCCI in confluence with price action or other technical tools for confirmation.

Ready to take your trading to the next level? Download the WCCI Indicator for MetaTrader 5 now at IndicatorForest.com and experience precision-driven trading today!

Published:

Oct 22, 2025 05:45 AM

Category: