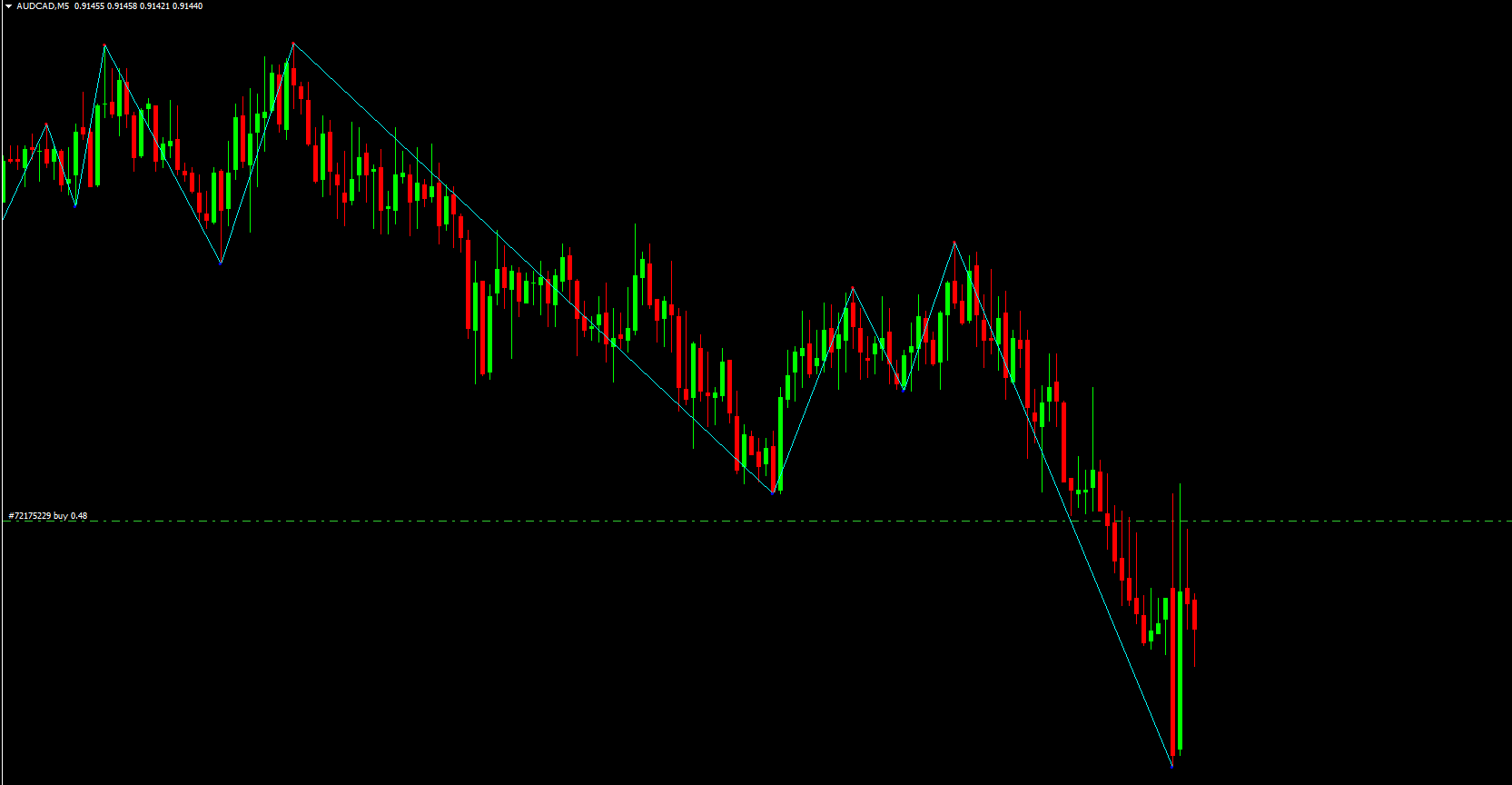

Forex swing traders often rely on tools that filter noise and highlight market structure. The Swing ZZ Zigzag Indicator for MT4 is one of the best indicators for this purpose. It smooths out minor price fluctuations and highlights major swing highs and lows, helping traders clearly identify trend direction, support, and resistance. By focusing only on meaningful price moves, the Swing ZZ Zigzag indicator enables traders to analyze the chart with improved clarity and precision.

One of the indicator’s greatest advantages is its ability to support a top-down trading approach. Trends that begin on higher timeframes become much easier to track on lower timeframes using the Zigzag swings. This allows traders to spot ideal entry points in alignment with larger market trends, improving trade timing and risk management.

The Zigzag indicator reduces chart noise by ignoring small fluctuations and highlighting only significant price swings. This is especially useful for swing traders who aim to follow trending markets rather than responding to every small retracement.

The indicator plots Blue dots for swing lows and Red dots for swing highs. These visual markers allow traders to quickly see whether the market is forming higher highs, higher lows, lower highs, or lower lows—key components of classic trend structure.

Because the Zigzag identifies major points where price turns, it is also widely used by Expert Advisors and algorithmic trading systems to determine trend strength, breakouts, and potential reversal zones.

The GBPUSD H4 example in your reference shows how swing points generated by the indicator help identify entries and exits.

In a downtrend:

Price breaks below the previous swing low

This confirms continuation of the bearish trend

A SELL order can be placed once structure breaks

In an uptrend:

Price breaks above the previous swing high

This signals continuation of an upward trend

A BUY order can be placed with trend confirmation

These simple yet powerful principles make the indicator suitable for both beginners and experienced traders.

The Swing ZZ Zigzag indicator excels in multi-timeframe analysis. Consider an example where GBPUSD is trending upward on the H4 chart. The broader trend is visible, but entries are easier to find on a lower timeframe—such as the M30 chart.

Higher timeframe defines the overall direction

Lower timeframe provides precise swing points

Support and resistance areas become clearer

Traders can enter early and exit before trend exhaustion

This combination produces highly accurate entries because the Zigzag on lower timeframes reveals micro-swings that align with the major trend.

Every forex pair behaves differently. A trending pair like GBPJPY may require a higher minBars value, while pairs with smoother movements may need a lower value. Testing different settings helps achieve balance between sensitivity and accuracy.

While the indicator is strong for identifying market structure, it should be combined with:

Moving averages

RSI or stochastic oscillators

Price action patterns

Breakout or pullback strategies

The Swing ZZ Zigzag indicator works best in trending markets. During sideways or ranging conditions, swing highs and lows become clustered, making signals less useful.

The Swing ZZ Zigzag Indicator for MT4 is a powerful trend-trading tool that enhances clarity by reducing noise and highlighting swing structure. It supports top-down analysis, offers excellent entry and exit points, and helps traders track support and resistance with precision. Although it should not be used in isolation, its accuracy in trending markets makes it one of the most successful and reliable indicators available.

To explore more advanced trading tools, visit IndicatorForest.com.

Published:

Nov 28, 2025 08:50 AM

Category: