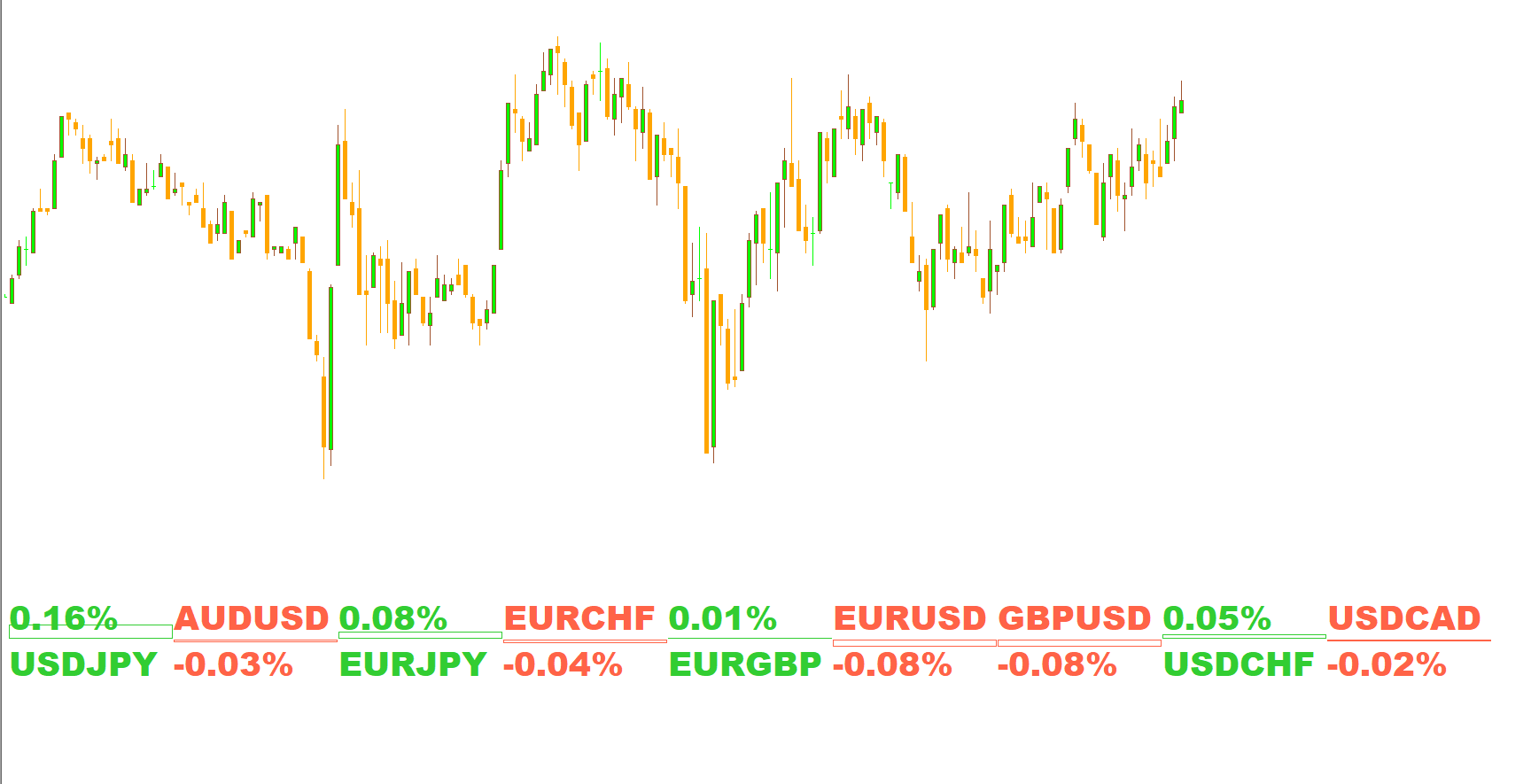

The Rate of Change (ROC) Indicator for MT4 is a simple yet effective momentum-based indicator that measures the percentage change in price over a specific time period. In essence, it calculates how fast and in which direction the price of a currency pair is moving — giving traders a clear view of market momentum and sentiment.

This indicator helps traders quickly identify whether the market is dominated by bulls (buyers) or bears (sellers). It does so by plotting each currency pair in green or red:

Green color: Indicates upward momentum (bullish sentiment).

Red color: Indicates downward momentum (bearish sentiment).

The ROC indicator on MT4 applies to nine major and minor forex pairs, including:

USD/JPY, AUD/USD, EUR/JPY, EUR/CHF, EUR/GBP, EUR/USD, GBP/USD, USD/CHF, and USD/CAD.

By monitoring the ROC across these pairs, traders can assess overall market conditions and choose the strongest or weakest currencies for trading opportunities.

The ROC (Rate of Change) indicator measures how much the current price has changed compared to a previous price level over a defined period. This makes it a momentum oscillator, showing the strength and direction of price movements.

When the indicator line or histogram for a currency pair is:

Green: The pair is gaining strength; buyers are in control.

Red: The pair is weakening; sellers dominate the market.

The ROC indicator doesn’t generate explicit buy or sell signals — instead, it provides insights into price acceleration or deceleration, helping traders make informed decisions about potential entries or exits.

You can use the ROC on any timeframe, from short-term scalping charts to higher timeframes like daily or weekly, to determine long-term market direction.

Identify a currency pair showing green color on the ROC indicator.

Wait for the bullish trend to fully develop or show consistent strength.

Enter a BUY (long) position following the uptrend.

Place a stop-loss near the recent low or support level.

Exit the trade when the indicator turns red, signaling weakening bullish momentum.

Choose a currency pair that appears in red on the ROC indicator.

Confirm that the bearish trend is well-established.

Enter a SELL (short) position in line with the downtrend.

Place a stop-loss near the recent high or resistance area.

Exit the trade when the indicator color switches to green.

The ROC Indicator for MT4 offers several benefits that make it ideal for traders who value simplicity and accuracy:

Multi-Currency Analysis: Monitors nine major forex pairs simultaneously.

Quick Sentiment Overview: Instantly identifies which currencies are strong or weak.

Customizable Timeframes: Works on daily, weekly, or intraday charts.

Enhances Decision-Making: Helps traders choose the best currency pair to trade.

Momentum Confirmation: Useful for validating signals from other technical indicators.

Since the Rate of Change Indicator doesn’t generate direct entry or exit signals, it’s best to use it alongside other tools such as:

Moving Average (MA): Confirms the overall trend direction.

MACD: Provides additional momentum confirmation.

RSI (Relative Strength Index): Identifies overbought or oversold conditions.

Price Action Patterns: Helps determine ideal entry and exit points.

By combining ROC with these indicators, traders can develop a well-rounded strategy for detecting high-probability setups.

For intraday or swing trading, consider checking the ROC on a higher timeframe (e.g., daily or weekly) to confirm the broader market sentiment before executing trades on a shorter timeframe (e.g., M15 or H1). This multi-timeframe approach helps improve accuracy and reduce false entries.

At IndicatorForest.com, we provide high-quality MT4 indicators that simplify trading and enhance technical analysis. The Rate of Change (ROC) Indicator for MT4 is available for free download, allowing you to easily analyze momentum and make better trading decisions.

Visit our website today to explore more advanced MT4 tools, custom oscillators, and trend indicators designed to boost your forex performance.

Published:

Nov 11, 2025 21:05 PM

Category: