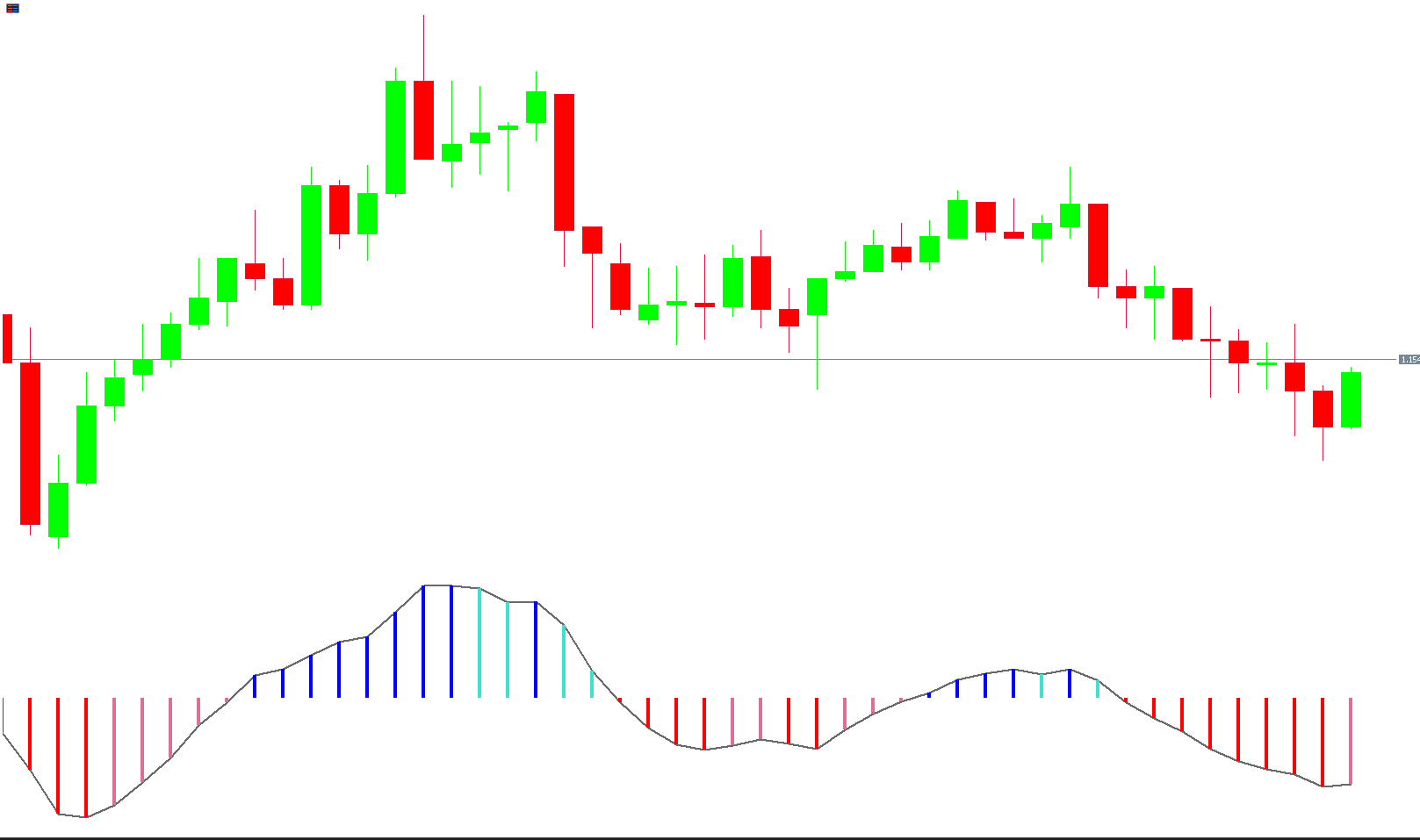

The NET BSP Indicator for MT5 (Buying Selling Pressure Indicator) is a powerful technical tool designed to measure and visualize the balance between buying and selling pressure in the market. By analyzing the relative volume of buyers and sellers, the indicator provides traders with key insights into whether the market is dominated by bullish or bearish sentiment.

In simple terms, this indicator shows the real market pressure, allowing traders to decide whether to take long or short positions with higher confidence. The NET BSP works effectively across all timeframes and can be combined with other tools for multi-timeframe analysis. Whether you’re a scalper, intraday trader, or swing trader, this indicator helps you stay aligned with the market’s true direction.

The NET BSP Indicator calculates and compares buying and selling volumes relative to the total trading volume.

Buying Pressure: When the buying volume outweighs the total volume, it signals a strong bullish trend.

Selling Pressure: When selling volume dominates, it indicates bearish sentiment.

The indicator plots a dynamic line that moves upward when buying pressure increases and downward when selling pressure grows. By observing this line, traders can assess market momentum and avoid trading against the prevailing force.

Because the NET BSP adapts to real-time data, it effectively reflects trend changes and reversals, helping traders catch movements early and manage risk better.

The NET BSP Indicator for MT5 shows clear market pressure readings through its line movement. It’s straightforward to interpret and can be used independently or alongside trend-following indicators such as Moving Averages, RSI, or MACD.

Enter a long position when the NET BSP line rises steadily, indicating increasing buying pressure.

The upward slope confirms that buyers are gaining control.

Exit the trade once the line starts to flatten or decline, signaling a potential loss of momentum.

Enter a short position when the indicator line falls, indicating rising selling pressure.

The downward slope shows that sellers dominate the market.

Exit when the line begins to rise again, showing a possible trend reversal.

Consider a EUR/USD H1 chart using the NET BSP Indicator.

During a downtrend, the indicator line drops sharply, confirming that selling pressure is increasing.

When the market experiences a bullish rally, the line rises correspondingly, indicating strong buying momentum.

When the line moves sideways, it signals a neutral or consolidating market, meaning traders should avoid taking large positions until momentum strengthens.

By combining the NET BSP with price action or support/resistance levels, traders can validate their entries and exits more effectively.

The NET BSP (Buying Selling Pressure) Indicator is an essential market analysis tool for traders who rely on volume and momentum insights. Its advantages include:

Provides a clear view of market dominance (buyers vs. sellers).

Works on all timeframes and currency pairs.

Suitable for scalping, day trading, and swing trading.

Helps identify trend direction and strength in real time.

Can be used alongside other technical indicators for signal confirmation.

Free download available from IndicatorForest.com.

The NET BSP Indicator for MT5 is a reliable and insightful tool that helps traders measure market pressure and momentum direction. By comparing buying and selling volumes, traders can determine when to enter or exit trades confidently.

Use the NET BSP to align with the market’s dominant force — go long when buying pressure is strong and go short when selling pressure increases. This indicator is perfect for traders seeking to understand the market’s underlying dynamics and improve their trading accuracy.

Download the NET BSP Indicator for MT5 now from IndicatorForest.com and enhance your technical trading strategy today.

Published:

Nov 10, 2025 03:05 AM

Category: