The FVG Positioning Average Indicator for MT5 is a powerful analytical tool developed by LuxAlgo to help traders identify how price reacts within Fair Value Gaps (FVGs). By calculating an average based on previous gap zones, the indicator plots these insights directly onto your chart as color-coded zones—making it easier than ever to assess market sentiment and potential reaction points.

Whether you’re focusing on intraday scalps or swing trading levels, the FVG Positioning Average Indicator offers clarity on where price action is most likely to respond. It’s especially beneficial for traders applying Smart Money Concepts (SMC) who want to analyze unmitigated gaps and gauge whether the market is currently leaning bullish or bearish within a broader structural context.

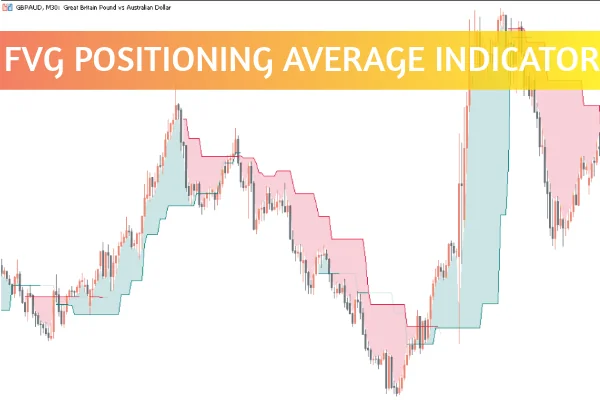

At its core, the indicator identifies and averages the positions of recent fair value gaps to highlight where price is most reactive. This calculation provides a visual representation of demand and supply zones on your MT5 chart.

Teal zones indicate areas where bullish reactions are dominant, suggesting active demand.

Crimson zones represent bearish reactions, signaling potential supply and resistance.

These dynamic zones shift in real time as new price data comes in, allowing traders to interpret directional momentum quickly and effectively. The visual feedback helps you decide whether the market is likely to continue trending or retrace from overextended levels.

When applied effectively, the FVG Positioning Average Indicator for MT5 serves as an advanced trend confirmation and reversal tool. By observing how price interacts with the colored zones, traders can anticipate potential turning points or continuation signals.

Bullish Scenario:

When the price remains above teal zones, it suggests consistent buy-side strength. Traders can look for pullbacks into these zones as potential long opportunities.

Bearish Scenario:

When crimson zones dominate and price consistently reacts below them, the market may be exhibiting sell-side control, presenting chances for short trades or countertrend reversals.

This indicator shines when combined with other LuxAlgo tools or traditional methods such as market structure analysis, volume profile, or liquidity zones.

The FVG Positioning Average Indicator MT5 stands out due to its simplicity and adaptability. Here’s why it’s becoming a favorite among professional and retail traders alike:

Visual Precision: Clean, color-coded zones make interpretation fast and intuitive.

Confluence-Friendly: Works seamlessly with Smart Money Concepts, supply-demand, and imbalance-based strategies.

Customizable Settings: Adjust visualization parameters and ATR-based calculations to fit your style.

Time-Saving Efficiency: Instantly highlights zones of interest without manual chart work.

By blending gap detection with adaptive ATR-based positioning, it gives you a statistical edge—showing where price is most likely to be drawn next.

Combine with Market Structure: Use swing highs/lows and liquidity sweeps to validate FVG reactions.

Watch for Confluence: Align with other indicators like LuxAlgo’s Smart Money Concepts or Order Block Detector for greater accuracy.

Adapt Across Timeframes: The indicator’s logic works effectively from M5 to H4 and even daily charts.

Use in Ranging Markets Carefully: FVG signals are strongest during trending or momentum-driven environments.

The FVG Positioning Average Indicator for MT5 by LuxAlgo is an indispensable tool for traders seeking to visualize and quantify price behavior within fair value gaps. With its clean design and reliable signal generation, it simplifies smart money analysis and helps traders stay on the right side of market momentum.

Experience precision trading today—explore this indicator and more advanced trading tools at IndicatorForest.com.

Published:

Oct 26, 2025 04:39 AM

Category: