The Envelope forex indicator for MT4 is a built-in technical analysis tool that helps traders identify potential price extremes, reversals, and stabilization zones. While visually similar to Bollinger Bands, the Envelopes indicator operates on a different assumption: that price tends to return to a balanced state after temporary abnormal movements caused by strong bullish or bearish pressure. Since the market spends most of its time in equilibrium, prices touching extreme levels of the Envelope bands can signal potential trading opportunities.

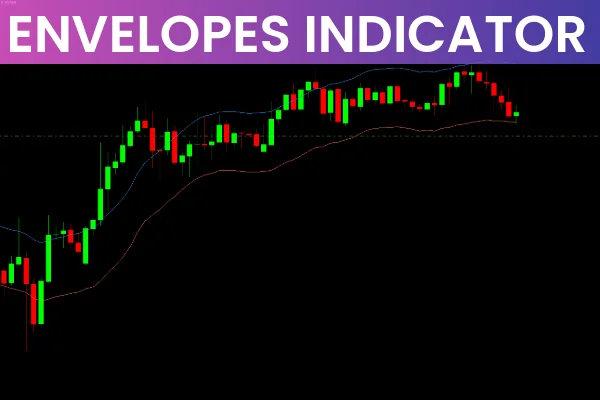

The Envelope indicator consists of two moving averages that create an upper and lower band, forming a price "channel." These bands adjust dynamically to market volatility, showing potential overbought and oversold areas. Unlike Bollinger Bands, which use standard deviation, the Envelopes indicator typically uses a percentage-based deviation.

On MT4, the default settings apply a 14-period moving average with a 0.1% deviation, creating two parallel lines surrounding price action. This “tape-like” appearance makes it easy to spot when price moves outside the normal range.

The Envelope bands change width depending on market conditions. When volatility increases, price may break above or below the bands—similar to Bollinger Band breakouts. These breakouts often signal that the market has moved too far too fast and may soon return to equilibrium.

Price touching lower band: Potential oversold condition

Price touching upper band: Potential overbought condition

Price breaking outside the band: Possible trend continuation or exhaustion

Price returning inside the band: Possible reversal signal

Because the indicator is centered around moving averages, traders often add a middle line to act as a mean-reversion target for Take Profit placement.

A buy or sell signal is considered more reliable when the price moves outside the Envelope band. However, confirmation from complementary tools—like RSI, price patterns, or volume indicators—is highly recommended.

The Envelopes indicator performs best in sideways markets, where price oscillates between support and resistance.

Buy when price touches the lower band

Sell when price touches the upper band

Close a position if the band is broken

When price violates the band boundary, the Envelope acts like a price channel, indicating the potential for trend development or volatility expansion.

To reduce false signals, do not enter a trade immediately when price touches a band. Instead:

Wait for a break,

Then wait for price to re-enter the band from the opposite direction.

This technique helps filter out noise and increases the probability of success.

The standard deviation in Envelopes is based on % deviation rather than the statistical measure used in Bollinger Bands. When experimenting with the MT4 settings:

Deviations above 2% will create a channel that is too wide, reducing sensitivity.

A deviation range of 0.1% to 2% is preferred for balanced performance.

Use higher timeframes:

The indicator performs more reliably on M30 and above.

Wait for price confirmation:

At least one candle should close inside the band before executing a trade.

Use additional indicators:

RSI works excellently for confirming overbought and oversold conditions.

Place pending orders:

Take Profit: Middle of the Envelope channel

Stop Loss: 5 points above/below previous local highs or lows

These rules create a structured, risk-managed approach suitable for beginners and advanced traders.

The Envelope forex indicator for MT4 is a powerful, easy-to-use tool based on moving averages and designed to identify price extremes, reversals, and equilibrium zones. Although it resembles Bollinger Bands, it offers unique advantages in range-bound markets and mean-reversion strategies. Always combine Envelopes with additional indicators like RSI for improved accuracy.

For more advanced indicators and expert trading tools, visit IndicatorForest.com.

Published:

Nov 28, 2025 03:32 AM

Category: