The ZigZag Close Indicator for MT4 is a powerful tool designed to eliminate market noise and highlight the true price structure of the forex market. Since currency prices rarely move in a straight line, traders often struggle to understand wave-like price movements, retracements, and swing highs/lows. This indicator solves that challenge by focusing solely on the closing price, providing a cleaned-up view of price action.

By connecting significant highs and lows, the ZigZag Close indicator presents a clear, simplified version of market structure. This makes it ideal for reading waves, analyzing trends, and identifying price turning points.

The indicator serves as a streamlined visual guide that helps traders:

Remove unwanted noise from charts

Identify swing highs and swing lows

Spot price waves and market structure shifts

Analyze Elliott Waves

Map Fibonacci retracement and extension levels

Because it is based on closing prices, the indicator is more stable than standard ZigZag variations. It provides a more realistic depiction of price progress from one point to another, making it especially helpful in high-volatility conditions.

The ZigZag Close indicator functions as a background analytical tool rather than a signal generator. It does not provide direct BUY or SELL arrows but instead simplifies the price pattern so traders can make informed decisions.

Instead of tracking every small price movement, the indicator filters out minor fluctuations. It plots only meaningful swing points based on your chosen parameters.

It is important to note that the indicator is a repaint indicator. This means the most recent ZigZag line can shift when a new high or low forms. Repainting is normal for all ZigZag-type tools because they rely on future price movement to confirm swing points.

With market noise removed, it becomes significantly easier to identify:

Double tops

Double bottoms

Head and shoulders patterns

Trend reversals

Harmonic patterns

Elliott Wave counts

These patterns are often hidden on a noisy price chart, making the ZigZag Close a valuable companion for structure-based trading.

Although the indicator is simple in design, it is highly effective when used correctly.

When using it on historical data, you can select a beginning and end point to analyze specific sessions. For current or live sessions, the endpoint adjusts dynamically based on price movement.

The indicator allows traders to visually track the market’s peaks and troughs:

Identify the direction of swings

Evaluate retracement depth

Observe wave progression

Mark significant highs/lows for trend confirmation

Because the ZigZag Close does not give direct BUY/SELL signals, it should be used alongside other technical tools such as:

Fibonacci retracements

Support and resistance

Moving averages

RSI or MACD

Harmonic patterns

Elliott Wave labeling tools

Confluence significantly increases the accuracy of your trading strategy.

The indicator itself does not provide fixed BUY or SELL signals. Instead, it acts as a confirmation tool for:

Elliott Wave counts

Harmonic pattern entries

Double bottom or double top formations

Trend reversal zones

Swing trading setups

For example, in a strong downtrend, a newly formed double bottom—clearly visible via the ZigZag Close—may indicate a potential BUY setup. Conversely, a double top or lower high may signal a potential SELL opportunity.

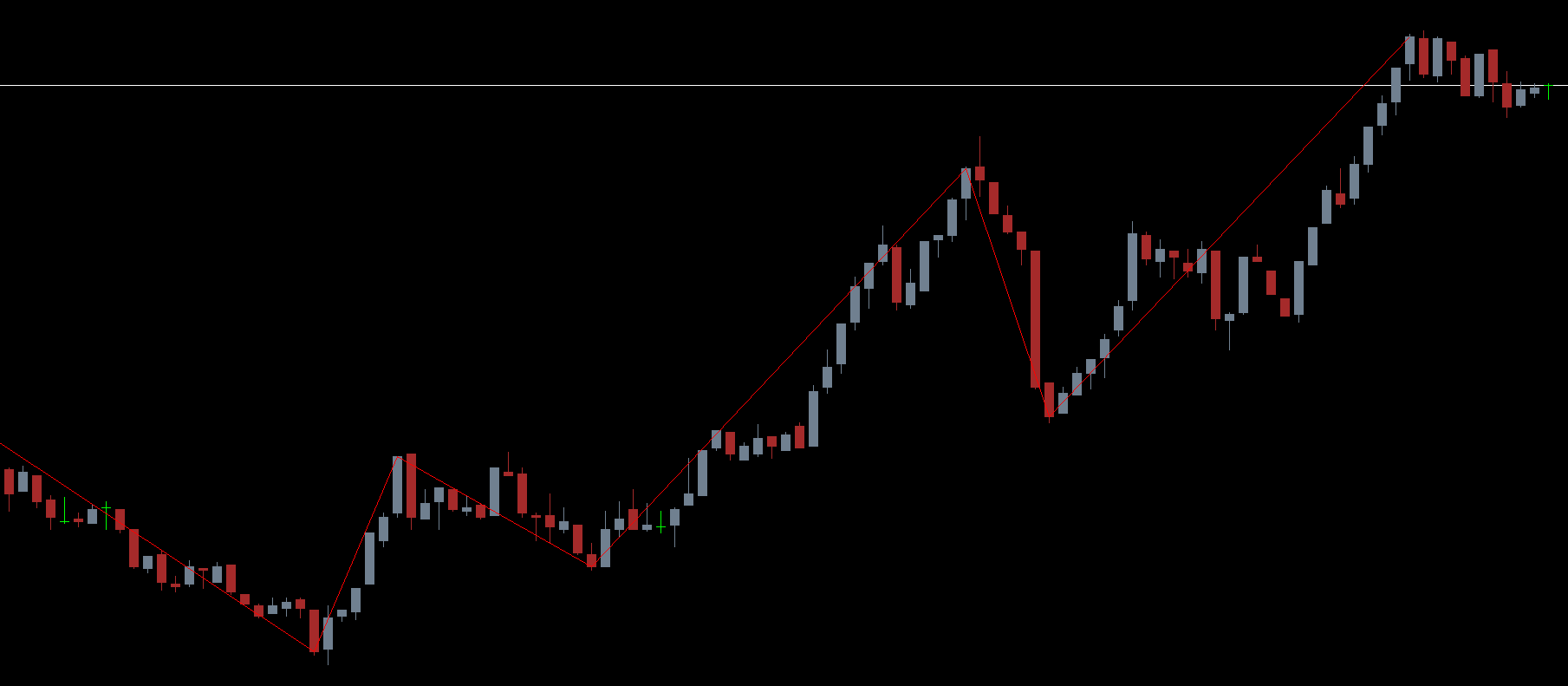

With default settings of 12, 5, 3, the ZigZag Close indicator on the USD/CAD H4 chart clearly highlights price waves:

A major high forms at 1.2318

A new low at 1.2086

Price retraces but fails to make a new high

A double bottom structure appears

The indicator removes market noise and makes the bullish reversal pattern easy to identify.

The ZigZag Close Indicator for MT4 is a powerful, noise-filtering tool that helps traders understand market waves, retracements, and swing structures. It should not be used in isolation but rather combined with Fibonacci tools, price action, and trend confirmation methods.

You can download the ZigZag Close Indicator for free from IndicatorForest.com and enhance your market structure analysis with this essential tool.

Published:

Nov 25, 2025 21:25 PM

Category: