The Volatility Ratio Indicator for MT5 is a technical tool designed to detect the presence or absence of market volatility. Unlike traditional indicators that may produce false signals in low-volatility conditions, the Volatility Ratio Indicator helps traders identify periods of market activity suitable for trading breakouts and trend continuation strategies.

Volatility-based indicators are essential for traders, as they form the foundation of many technical trading strategies. By monitoring market volatility, traders can make better-informed decisions and avoid unnecessary risks.

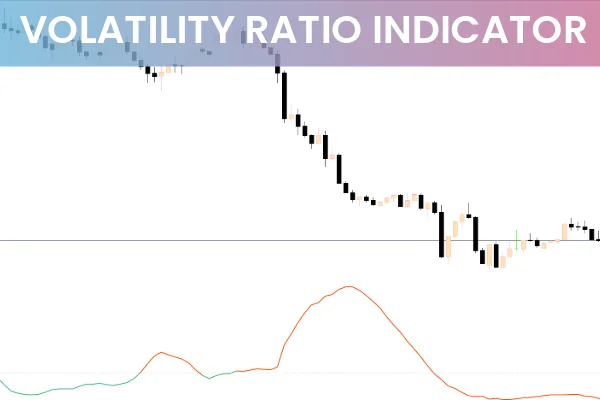

The Volatility Ratio Indicator is displayed in a separate window on the MT5 platform. Its color changes depending on market conditions:

Green Line: Indicates the presence of significant market volatility.

Orange-Red Line: Indicates low or absent volatility.

A value above 1 represents sufficient market volatility, while a value below 1 indicates low volatility. Traders can add a reference line at level 1 for visual clarity.

While the indicator does not provide direct buy or sell signals, it is extremely useful when combined with trend-following or breakout strategies:

Breakout Confirmation: High volatility often confirms a breakout from support or resistance levels. Low volatility may signal false breakouts or market indecision.

Trend Continuation: Traders can monitor volatility before entering trades in the direction of a confirmed trend.

Exit Strategy: Decreasing volatility can signal a potential profit-taking point or exit for open trades.

The Volatility Ratio Indicator is versatile and can complement various other MT5 indicators, including oscillators, bands, and meters, to create a comprehensive trading strategy.

Volatility measures the degree of price change of a currency pair over time. It can be classified as:

Historical Volatility: Analyzes past price movements to determine how volatile a currency pair has been.

Implied Volatility: Estimates future volatility based on market expectations.

Major economic events and news releases often cause spikes in volatility, which can be leveraged by traders for profitable trading opportunities.

The Volatility Ratio Indicator for MT5 is a valuable tool for identifying market volatility, helping traders distinguish between high and low activity periods. Although it does not provide trend direction or direct trade signals, combining it with other technical indicators allows traders to improve their trading accuracy and avoid false breakouts. Download the Volatility Ratio Indicator from IndicatorForest.com and enhance your forex trading strategy with volatility analysis.

Published:

Nov 12, 2025 00:35 AM

Category: