The MM Levels VG Indicator for MT5 displays support, resistance, and reversal zones using Murray Math levels. This tool is designed for Forex traders who want to eliminate guesswork in identifying key market levels. By combining mathematical precision with easy-to-read visual levels, it offers a structured way to understand market behavior and make informed trading decisions.

The indicator identifies overbought and oversold conditions, extreme reversal levels, and strong price reaction zones. Unlike subjective chart analysis, MM Levels VG provides objective entry and exit points, enhancing both accuracy and confidence in trading.

The MM Levels VG Indicator is based on Murray’s mathematical calculations. These levels divide the price range into eight equal parts, representing potential turning points. Each level has a specific signal meaning in terms of market sentiment and reaction strength.

Extreme Surges (+/-1/8P, +/-2/8P) – Displayed in white, showing possible price extensions beyond normal range.

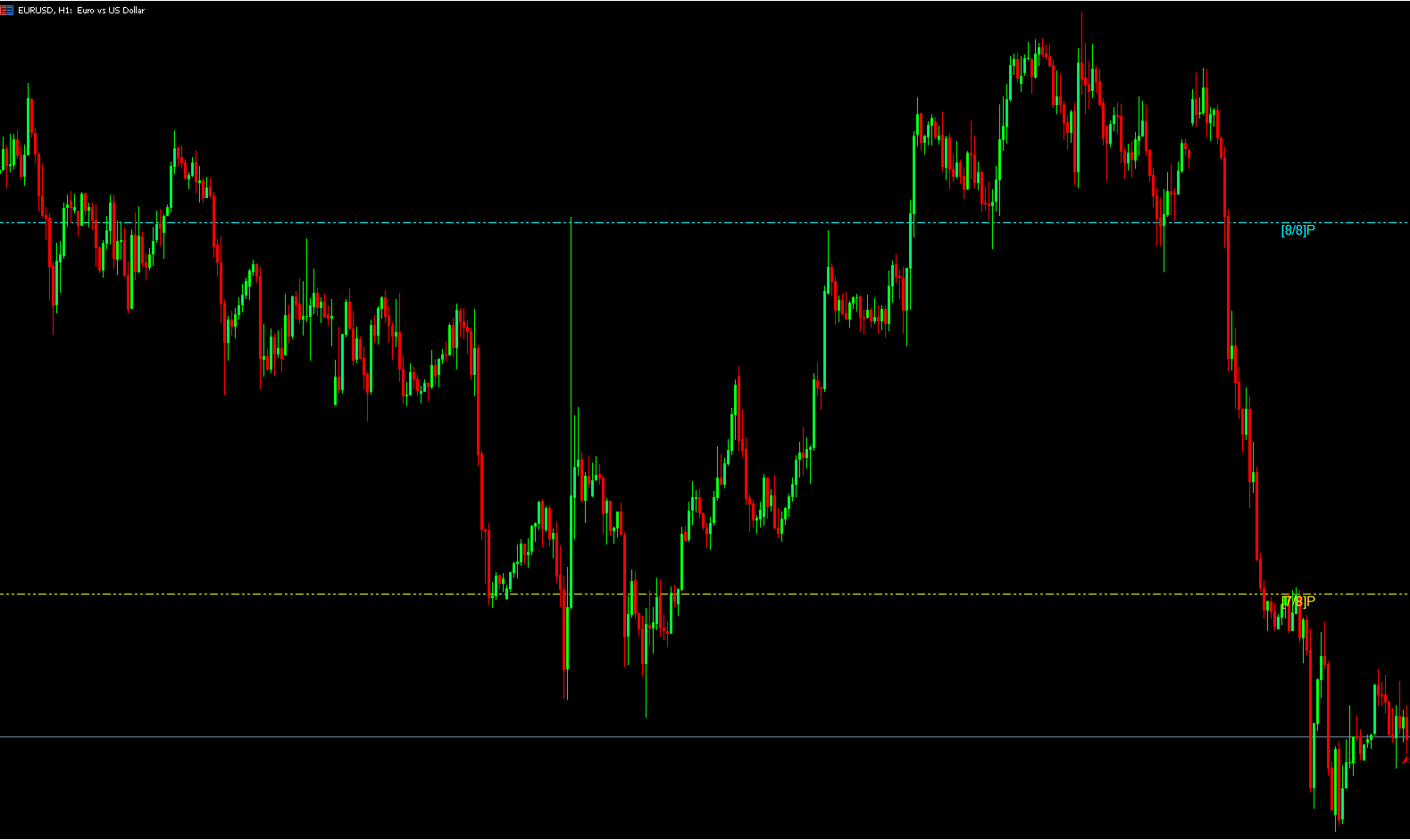

Extremely Overbought (8/8P) and Oversold (0/8P) – Shown in aqua, ideal for reversal trades.

Weak Stall and Reversal (7/8P, 1/8P) – Highlighted in yellow, indicating short-term correction zones.

Main Reversal Levels (6/8P, 2/8P) – Marked in red, powerful reaction points for major turnarounds.

Trading Range Boundaries (5/8P, 3/8P) – Displayed in green, where price tends to consolidate or range.

Central Level (4/8P) – Acts as a pivot point, often signaling a shift in market direction.

These visual cues make it easier for traders to anticipate price behavior across all timeframes, from M1 to monthly charts.

Once applied, the indicator automatically calculates and plots all Murray Math levels. Look for extreme levels (0/8P or 8/8P) to spot high-probability reversal areas.

Combine MM Levels VG with price action signals like candlestick reversals or divergence indicators to confirm potential entries.

Reversal Trades: Enter when price hits 0/8P or 8/8P with confirmation.

Trend Continuation Trades: Trade between 5/8P and 3/8P during consolidations.

Breakout Trades: Use 4/8P as a decision point for breakout confirmation.

Always apply stop-loss and take-profit levels based on nearby MM levels to ensure disciplined trade management.

Objective Analysis: Removes emotional bias from trading decisions.

Multi-Timeframe Support: Can be used on any MT5 chart period.

Simple and Effective: Suitable for both beginners and advanced traders.

Versatile Integration: Works well with other tools like Fibonacci retracements, Pivot Points, or Gann lines.

Whether you are a swing trader or a scalper, this indicator provides the structure needed to read markets efficiently.

Advanced users can combine MM Levels VG with:

RSI or MACD for divergence confirmation.

Moving Averages for trend validation.

Volume indicators to assess momentum near reversal levels.

These combinations strengthen entry and exit accuracy, making your Forex trading strategy more robust.

The MM Levels VG Indicator for MT5 is a powerful alternative to Fibonacci and Pivot indicators. It helps traders identify optimal trading zones based on precise mathematical logic, improving timing and confidence. Whether you’re a novice learning price structure or an expert optimizing entries, this indicator simplifies market analysis.

Visit IndicatorForest.com today to download the MM Levels VG Indicator for MT5 and elevate your trading strategy.

Published:

Nov 07, 2025 13:19 PM

Category: