The MACD Zero Cross Indicator for MT4 is a popular technical tool designed for forex and stock traders who want to identify trend reversals and entry points with precision. It is based on the Moving Average Convergence Divergence (MACD) principle, which measures the relationship between two moving averages of price.

This indicator is widely used by both scalpers and intraday traders because it produces frequent and reliable signals—especially on lower timeframes (M1–M30). However, it can also be used effectively on H1 or higher timeframes for more accurate, trend-based confirmations.

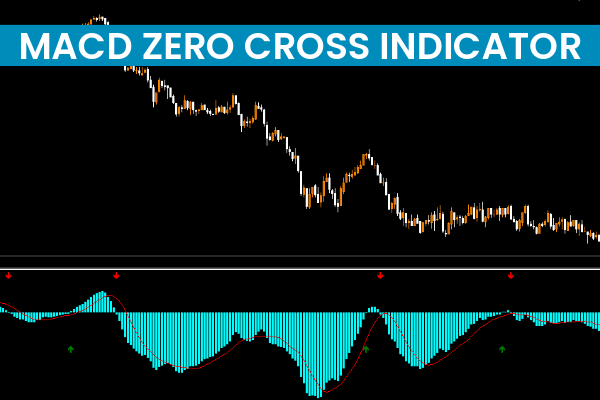

The MACD Zero Cross Indicator offers visual cues, including signal lines, histogram bars, and arrows, helping traders easily spot bullish and bearish setups without manually analyzing raw MACD data.

At its core, the MACD Zero Cross indicator tracks the crossover of the MACD line and the signal line:

When the MACD line crosses above the signal line, it suggests a bullish momentum shift, often signaling a buy opportunity.

When the MACD line crosses below the signal line, it indicates bearish momentum, potentially marking a sell opportunity.

Additionally, the indicator plots these signals on the chart using arrows or colored histograms, allowing traders to visually confirm the trend direction at a glance.

It can be customized to match different trading styles — whether you prefer quick scalping setups on M5 charts or swing trading on higher timeframes like H4.

Wait for the MACD line to cross above the signal line.

A bullish arrow or histogram bar will usually appear below the zero line.

Enter a buy trade when price action confirms the upward momentum.

Set a stop-loss below the recent swing low.

Take profit at key resistance levels or when the MACD line starts to flatten.

Wait for the MACD line to cross below the signal line.

A bearish arrow or histogram bar appears above the zero line.

Enter a sell trade once bearish momentum is confirmed.

Set stop-loss above the recent swing high.

Exit when the histogram shows weakening bearish pressure or near support levels.

Pro Tip: Combine the MACD Zero Cross with support and resistance zones, moving averages, or candlestick patterns (like engulfing patterns) for stronger confirmations and reduced false signals.

Easy to interpret: Clear visual signals using arrows and histograms.

Flexible: Works on all timeframes and instruments (forex, stocks, indices, crypto).

Dynamic: Adapts quickly to changing market momentum.

Customizable: Modify MACD settings to suit different strategies.

Great for both beginners and pros: Simplifies market analysis without sacrificing accuracy.

While the MACD Zero Cross Indicator provides reliable signals, proper risk management is essential for long-term success.

Never risk more than 1–2% of your account balance per trade.

Use stop-losses and trailing stops to protect profits.

Always trade in the direction of the higher timeframe trend.

Avoid trading during major news events, as volatility can cause false crossovers.

By combining this indicator with sound risk control and market context, traders can improve both accuracy and consistency.

The MACD Zero Cross Indicator for MT4 is a highly effective trend-following tool that helps traders identify buy and sell opportunities based on MACD crossovers. Its simplicity, visual clarity, and adaptability make it suitable for all trading styles — from scalping to swing trading.

Whether you’re a beginner learning market trends or an experienced trader refining your strategy, this indicator can significantly enhance your decision-making process.

Download the MACD Zero Cross Indicator for free at IndicatorForest.com and start trading smarter with confidence today!

Published:

Nov 06, 2025 12:30 PM

Category: