The JPY Strength Index Indicator for MT4 is a powerful forex trading tool designed to measure the overall strength or weakness of the Japanese Yen (JPY). By tracking the performance of the Yen against multiple major currencies—including USDJPY, EURJPY, GBPJPY, AUDJPY, NZDJPY, CADJPY, and CHFJPY—the indicator creates a comprehensive and dependable index value.

This strength index gives traders a clear view of how the Yen performs in the global market, making it easier to identify trend direction, reversals, and breakout opportunities. Whether you are a scalper, swing trader, or long-term investor, the JPY Strength Index Indicator for MT4 offers valuable insights for more confident decision-making.

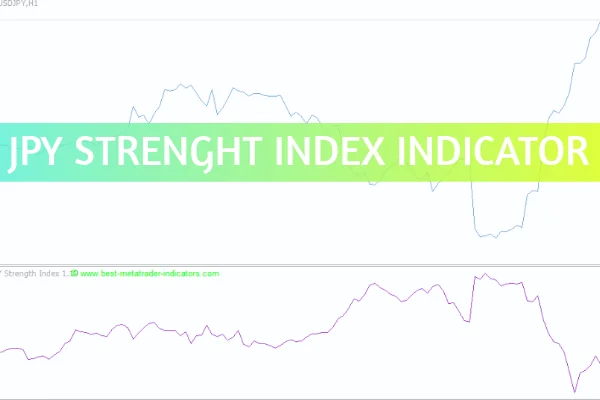

The indicator plots a dark orchid-colored line on a separate window in the MetaTrader 4 (MT4) platform. This line represents the cumulative performance of JPY across the main forex pairs.

When the line trends upward, it signals that the Yen is strengthening relative to other currencies. Conversely, when the line declines, the Yen is weakening. These movements often precede broader price trends in the JPY pairs, allowing traders to anticipate market momentum early.

For example, if USDJPY starts to fall while the JPY index rises, it often indicates growing strength in the Yen—possibly signaling a broader bearish move in JPY pairs.

Unlike individual pair analysis, the JPY Strength Index consolidates data from all major JPY pairs. This offers a clearer and more stable trend signal, filtering out short-term noise and volatility.

As one or two Yen pairs start to move, the indicator often reflects these initial shifts before they become widespread. Traders can enter trades earlier, maximizing potential profits as the trend develops.

The JPY Strength Index Indicator also helps in breakout trading. When a chart pattern or candlestick setup appears, the direction of the breakout often aligns with the dominant trend indicated by the index—offering confirmation for stronger trade setups.

From scalpers to long-term traders, everyone can benefit from this tool. Its adaptability across timeframes and chart types makes it a versatile component of any forex strategy.

Add the indicator to your MT4 platform and open the Yen-based pairs such as USDJPY or EURJPY.

Observe the index line direction—an upward slope suggests Yen strength, while a downward slope signals weakness.

Combine the signal with price action or other technical tools (like moving averages or support/resistance levels) for confirmation.

Use the indicator to filter false breakouts and stay in profitable trades longer by focusing on the overall trend direction.

Use the JPY Strength Index Indicator alongside USD or EUR strength indices for intermarket comparison.

Avoid overtrading during low-volume sessions, as the index may produce flat or unclear readings.

Regularly monitor multiple timeframes to align short-term entries with long-term trends.

In conclusion, the JPY Strength Index Indicator for MT4 is an essential tool for traders who want to measure the real power of the Japanese Yen across multiple pairs. It simplifies complex market data into a single, easy-to-read line, helping you make smarter, more confident trading decisions.

Explore and download the JPY Strength Index Indicator for MT4 today at IndicatorForest.com and take your forex trading to the next level.

Published:

Oct 24, 2025 10:01 AM

Category: