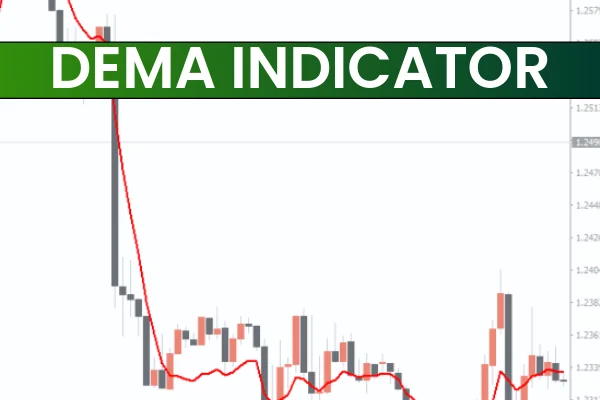

The DEMA Indicator, also known as the Double Exponential Moving Average, is a powerful trend-following tool designed to reduce lag and provide faster trading signals. Unlike traditional moving averages that rely on a single smoothing process, the DEMA applies a dual calculation method, allowing traders to identify trend reversals and continuations with improved accuracy. Whether you trade on MT4 or MT5, the DEMA indicator helps you stay aligned with the market’s true momentum.

The DEMA is especially useful for intraday traders, scalpers, and swing traders who depend on precision. By reacting faster to price changes, the indicator offers earlier BUY and SELL signals compared to the standard EMA or SMA. This speed makes it an essential addition to any technical trader’s toolkit.

Understanding the DEMA Indicator

The Double Exponential Moving Average is calculated using a combination of EMA values and additional smoothing. This process produces a line that reduces the delay often seen in standard moving averages. As a result, the DEMA provides a clearer view of the current trend direction.

Why DEMA Is More Accurate Than Standard Moving Averages

Traditional moving averages lag behind price because they average historical data. DEMA minimizes this lag through its unique formula:

It reacts faster to sudden price changes.

It smooths out noise better than a simple moving average.

It provides sharper trend insight for earlier entries.

This makes the DEMA a reliable tool for identifying emerging trends or spotting reversals before they fully develop. heading lines text big hu

How to Trade Using the DEMA Indicator

Trading with the DEMA indicator is straightforward, making it ideal for both new and advanced traders.

Using DEMA for Trend Identification

When the DEMA line slopes upward, the market is in a bullish trend, and traders can look for BUY opportunities. Conversely, a downward-sloping DEMA indicates a bearish trend, signaling SELL opportunities.

Entry and Exit Strategy

BUY Setup:

Price crosses above the DEMA line.

DEMA begins to slope upward.

Place stop-loss below the recent swing low.

SELL Setup:

Price crosses below the DEMA line.

DEMA slopes downward.

Place stop-loss above the recent swing high.

Traders can also combine DEMA with other tools such as RSI, MACD, or support/resistance zones to confirm signals and filter false entries.

DEMA Crossover Strategy

A popular method is using two DEMA lines: one fast and one slow.

Bullish Signal: Fast DEMA crosses above the slow DEMA.

Bearish Signal: Fast DEMA crosses below the slow DEMA.

This crossover method helps traders identify stronger trend shifts.

Benefits of the DEMA Indicator

The DEMA indicator offers several advantages that make it superior to standard moving averages:

Reduced Lag: Faster reaction to market movements.

More Accurate Trend Signals: Ideal for fast-moving markets.

Versatile: Works on MT4 and MT5 across all timeframes.

Excellent for Scalping & Day Trading: Provides quick signals.

Works with All Strategies: Trend trading, breakouts, pullbacks, and reversals.

Tips for Using DEMA Effectively

Combine DEMA with additional indicators to confirm signals.

Avoid trading during ranging markets unless used with oscillators.

Test different DEMA periods to match your trading style.

Always apply proper risk management and stop-loss rules.

Use higher timeframe DEMA as a trend filter for stronger accuracy.

Conclusion

The DEMA Indicator for MT4 and MT5 provides a fast, reliable method of identifying trends and spotting market reversals. Its reduced lag and enhanced accuracy make it a superior alternative to traditional moving averages. Whether you are a scalper or a swing trader, the DEMA can significantly improve your strategy.

Download the DEMA Indicator for free today at IndicatorForest.com and upgrade your trend-trading performance.

Published:

Nov 24, 2025 14:42 PM

Category: