The Asian Breakout Range Indicator for MT4 is a practical tool designed to help traders identify profitable breakout opportunities during the Tokyo market session. By plotting the Asian session high and low along with the breakout range, this indicator provides a clear framework for session-based breakout trading.

Traders looking for short-term trades or scalping opportunities during the Asian session can greatly benefit from the visual guidance offered by this tool. Available for free download at IndicatorForest.com, the Asian Breakout Range Indicator simplifies the process of spotting potential bullish or bearish breakouts.

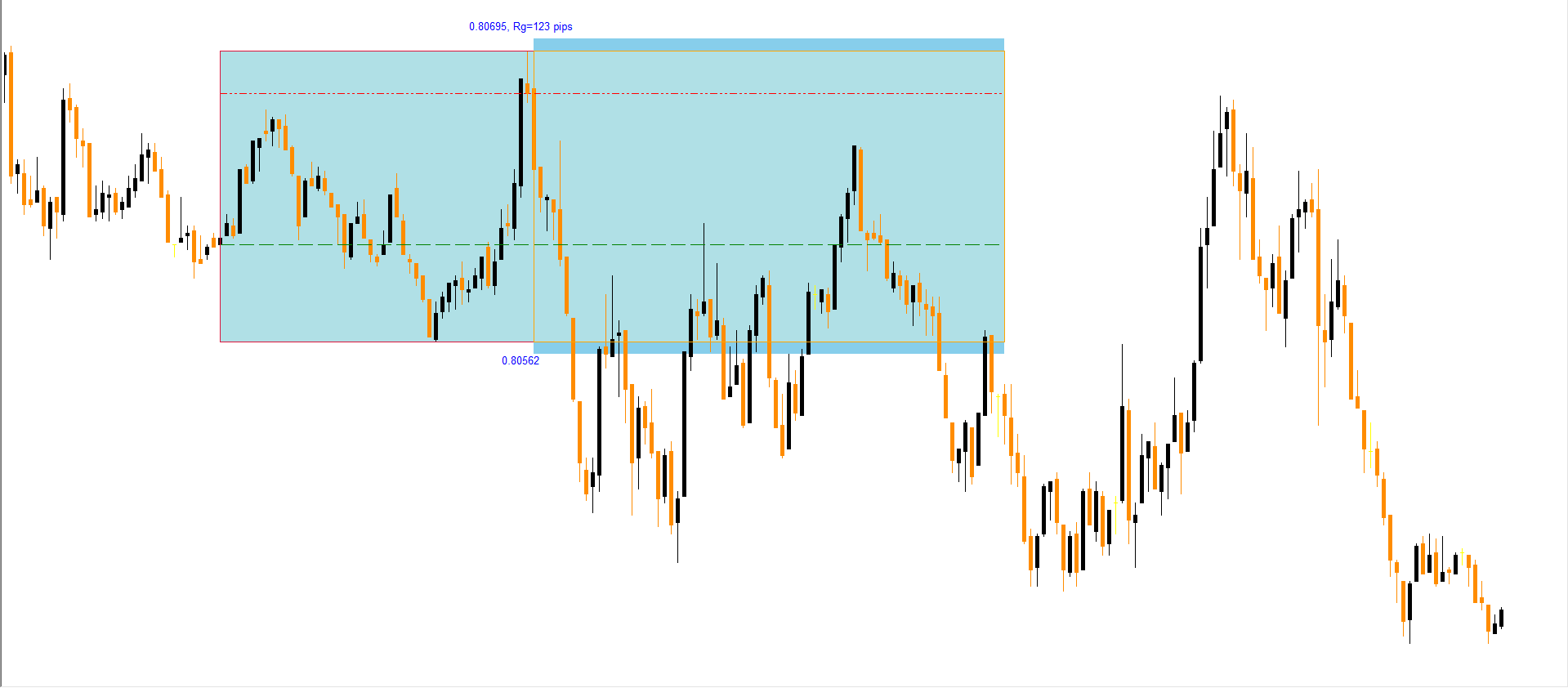

The indicator functions by visually marking the price range of the Asian session in both text and colored box format. The box outlines the upper and lower boundaries where price activity is expected to remain during the session.

Key features of the indicator include:

Text Display: Shows the current session range in pips for quick reference.

Breakout Zone Box: Highlights potential breakout levels on the chart.

Buy/Sell Signals: A breakout above the upper boundary signals a buy opportunity, while a breakout below the lower boundary signals a sell opportunity.

By clearly displaying these zones, the indicator allows traders to focus on high-probability breakout trades while filtering out unnecessary market noise.

Identify the Session Range:

Attach the indicator to your MT4 chart and note the upper and lower boundaries of the Tokyo session.

Confirm Market Trend:

Before trading, determine the overall market trend using moving averages, trend lines, or higher timeframe analysis. This helps increase the probability of a successful breakout trade.

Entry Rules:

Bullish Breakout: Price closes above the box → enter a buy trade.

Bearish Breakout: Price closes below the box → enter a sell trade.

Stop Loss & Take Profit:

Place stop-loss orders just inside the breakout box to reduce risk.

Use previous support/resistance levels or a multiple of the breakout range for take-profit targets.

Avoid False Breakouts:

Confirm breakouts with additional indicators such as volume, candle patterns, or trend confirmation tools.

Be cautious during low volatility periods or news releases that may cause erratic price spikes.

This approach allows traders to capitalize on high-probability breakout setups while maintaining disciplined risk management.

Session-Based Analysis: Focuses specifically on the Tokyo market session.

Visual Breakout Zones: Clearly highlights potential buy/sell areas.

Time-Saving: Reduces the need to manually calculate session highs and lows.

Easy to Use: Suitable for beginners and advanced traders alike.

Flexible Application: Can be used on Forex, commodities, and stock CFDs.

By incorporating this indicator into your MT4 trading strategy, you can simplify breakout trading and gain better control over entry and exit points.

The Asian Breakout Range Indicator for MT4 is a valuable tool for traders seeking session-based breakout opportunities, especially during the Tokyo session. While it is not suitable for all trading styles or market conditions, it provides clear visual guidance to enhance decision-making for short-term trades.

As with any trading tool, backtesting and combination with other indicators is essential. Successful trading requires discipline, patience, and a willingness to continuously adapt strategies based on market behavior.

👉 Download the Asian Breakout Range Indicator free at IndicatorForest.com and start spotting high-probability breakout opportunities today!

Published:

Nov 10, 2025 14:29 PM

Category: